Currency CFDs: Trading Forex Pairs with Confidence

cfd trading has become a preferred investment option for many dealers. This is a quick and easy approach to industry a variety of possessions, such as stocks, indices, and items. CFDs enable dealers to speculate in the value movements of fundamental belongings without actually buying the resource. The potential for high profits and the simplicity of entry have attracted many traders to the method of buying and selling. In this particular complete information, we will discover everything you need to know about CFD investing, from simple methods to innovative tactics.

1. Understanding CFDs:

CFD means Agreement for Big difference, and is particularly an agreement between two celebrations. The buyer agrees to spend the owner the visible difference between your closing and opening prices of any asset. CFDs are leveraged products, and therefore dealers can business with a tiny amount of funds and still control larger industry dimensions. The leverage utilized in CFD investing can magnify the earnings, but it will also improve the risk of loss. As a result, it is essential to know the risks involved with CFD investing before making an investment anything.

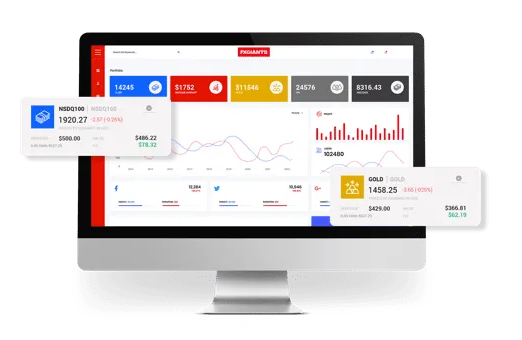

2. Selecting the best agent:

One of several vital techniques in CFD investing is selecting the best brokerage. The dealer which you choose may affect your general buying and selling encounter. You ought to pick a dealer that offers a trusted investing platform, very competitive propagates, lower profits, and fast execution. It’s also essential to pick an agent which is regulated with a reliable expert to ensure that your money are safe.

3. CFD Investing Strategies:

There are numerous forex trading methods that traders are able to use to maximize their earnings and reduce their dangers in CFD forex trading. Some preferred tactics incorporate craze subsequent, swing investing, and scalping. Craze following consists of using the tendency of your industry and using positions toward the craze. Swing buying and selling requires capturing short to method-phrase variances in the market. Scalping consists of producing frequent deals, using little value motions in the marketplace.

4. Risk administration:

Chance control is essential in CFD buying and selling. Investors should use end-loss purchases to limit their deficits in case the marketplace techniques against them. It’s also essential to get a suitable trading strategy and stick to it. Investors should never danger more than they may afford to lose and ought to not permit emotions control their buying and selling choices.

5. Education and learning and rehearse:

Schooling and practice will be the tips for accomplishment in CFD buying and selling. Investors should find out as much as they could regarding the trading markets, forex trading strategies, and danger control. They must also process forex trading with a demo bank account before employing actual money. This enables them to acquire expertise and check their techniques without risking any funds.

Summary:

CFD trading could be a great purchase possibility, but it also comes along with dangers. To turn into a successful CFD forex trader, you must understand basic principles of CFD buying and selling, choose the right brokerage, use powerful investing techniques, and practice correct threat managing. With determination, self-control, and education and learning, you are able to master CFD buying and selling and achieve your financial targets.